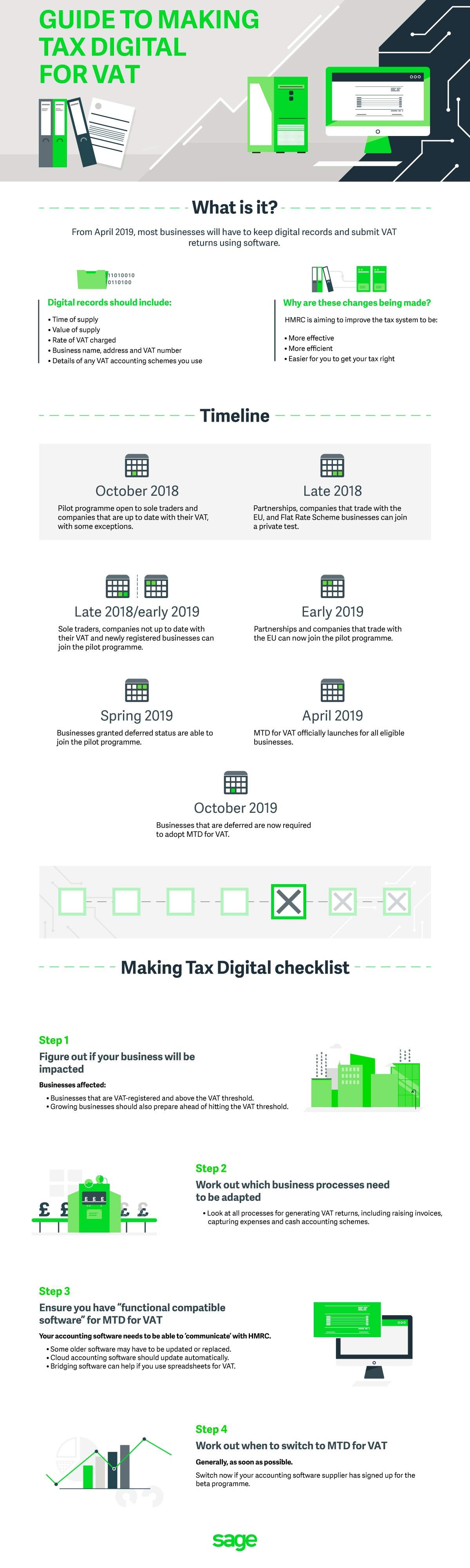

Making Tax Digital is the government’s flagship scheme that requires online tax filing and payment, as well as digital record keeping. All business taxes will be part of the scheme, but only Making Tax Digital for VAT currently has an actual roll-out date, with the rest following in 2020 at the earliest.

The impact on businesses large and small is likely to be significant. The government says Making Tax Digital will reduce tax errors and therefore generate £610 million in extra revenue in 2020-21. However, HMRC also emphasises the benefits of digital record keeping for businesses, including real-time record keeping.

For more information please visit Sage.